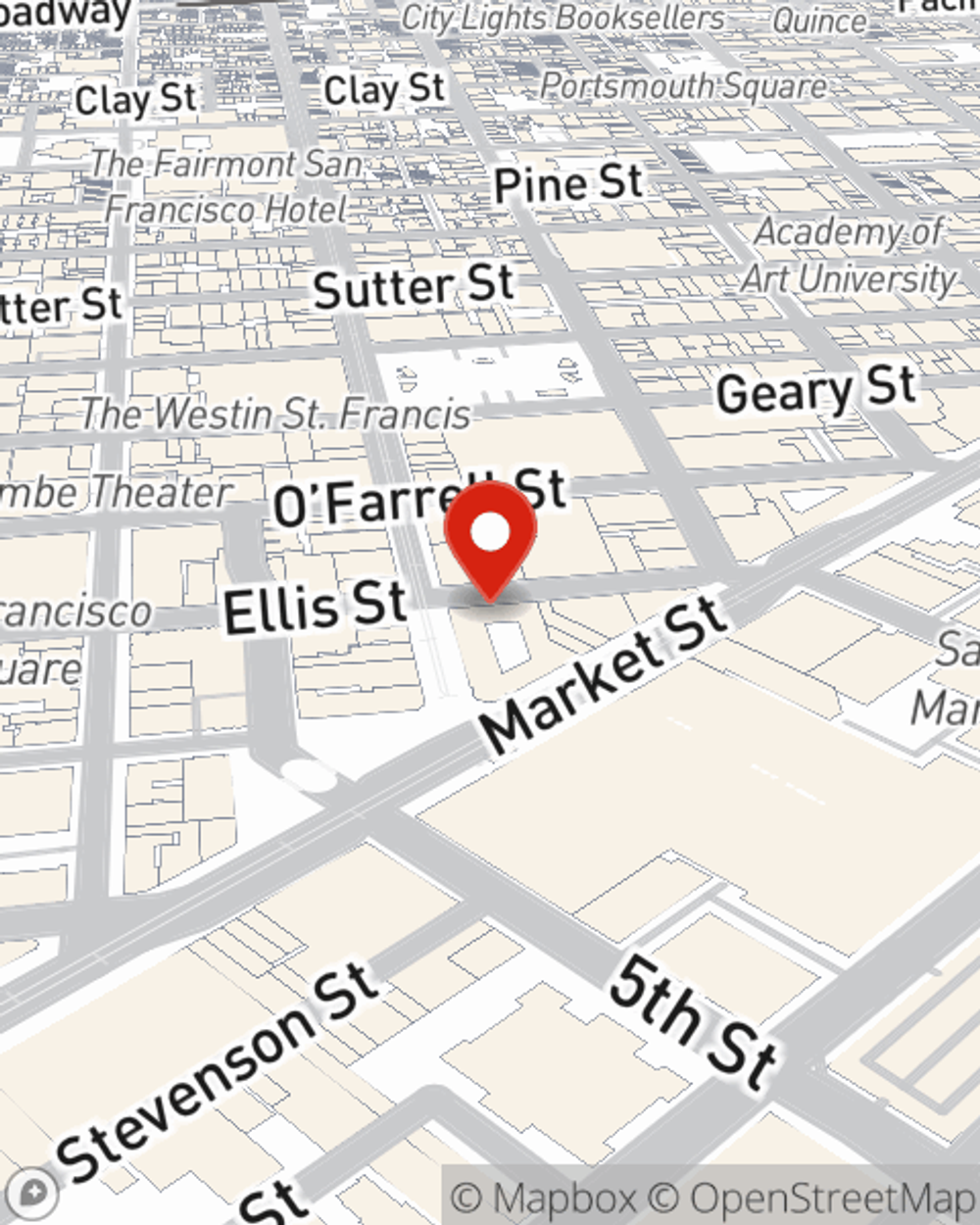

Auto Insurance in and around SAN FRANCISCO

Looking for great auto insurance around the SAN FRANCISCO area?

Take this route for your insurance needs

Would you like to create a personalized auto quote?

- San Francisco

- SF Bay Area

- California

- Silicon Valley

- Marin

- Los Angeles

- Monterey

- Sacramento

- Berkeley

- Oakland

- Santa Barbara

- San Diego

- Walnut Creek

Be Prepared For The Accidents Of Life

Daily routines keep all of us on the go. We drive to book clubs, violin lessons, social gatherings and lunch meetings. We go from one thing to the next and back again, almost automatically… until mishaps occur: things like cracked windshields, theft, wind storms, and more.

Looking for great auto insurance around the SAN FRANCISCO area?

Take this route for your insurance needs

Agent Debra O'farrell, At Your Service

That’s why you need State Farm auto insurance. When the unexpected happens, State Farm is there to get you back on track! Agent Debra O'Farrell can walk you through the whole insurance process, step by step, to review State Farm's options for coverage and deductibles. You’ll get high-quality coverage for all your auto insurance needs.

State Farm agent Debra O'Farrell is here to help explain all of the options in further detail and work with you to set up a policy that fits your needs. Call or email Debra O'Farrell's office today to learn more.

Have More Questions About Auto Insurance?

Call Debra at (415) 982-9900 or visit our FAQ page.

Simple Insights®

Things to consider when buying a car

Things to consider when buying a car

Trade-ins, payments, purchase price and down payments are all things to consider when buying a car. They can help you find the right car for your needs and wants.

Car stolen or damaged by hail? Help understand comprehensive insurance

Car stolen or damaged by hail? Help understand comprehensive insurance

Learn what comprehensive auto insurance covers (theft, hail, vandalism & more), how it differs from collision, and why it’s important.

Debra O'Farrell

State Farm® Insurance AgentSimple Insights®

Things to consider when buying a car

Things to consider when buying a car

Trade-ins, payments, purchase price and down payments are all things to consider when buying a car. They can help you find the right car for your needs and wants.

Car stolen or damaged by hail? Help understand comprehensive insurance

Car stolen or damaged by hail? Help understand comprehensive insurance

Learn what comprehensive auto insurance covers (theft, hail, vandalism & more), how it differs from collision, and why it’s important.